TIDAL LOANS PROVIDES HARD MONEY LOANS IN AUSTIN AND SURROUNDING AREAS.

Are you looking to invest in a new real estate market, but have no idea where to begin? Austin has become the hottest real estate market in Texas , but this has made purchasing that much more of an intimidating and complicated process. You need a lender that has both the experience and knowledge of the market, and that is what Tidal Loans provides Austin investors – over 50 years of experience!

Austin Private Money Lenders

Tidal Loans specializes in speed, simplicity, and above everything else, transparency. Whether you are new or experienced with real estate investments, you may not want to part with a considerable amount of cash up front to purchase real estate. You may also not want your loan to be determined by your credit score or tax returns. This is where a hard money lender in Austin can help.

How Can Hard Money Lenders in Austin, Texas Help?

Hard money lenders in Austin, Texas, such as Tidal Loans provide an alternative route for financing real estate projects. We offer different types of loans such as hard money loans, flip loans, construction loans, and bridge loans. These financial products are designed specifically to suit the varied requirements of real estate investors. The primary emphasis of a hard money lender is on the potential value of the investment property and not exclusively on the borrower’s credit score. This focus on the property’s worth can provide funding opportunities for investors with less-than-stellar credit histories, enabling them to participate in the real estate market.

Austin hard money lenders also stand out due to their ability to fund loans faster than traditional lenders. This expedited process can be crucial in a competitive market where quick action often determines whether an investor secures a deal or not. For instance, flip loans can assist an investor in quickly purchasing a property, renovating it, and selling it for a profit. Construction loans can be crucial for new projects, while bridge loans offer short-term solutions for investors between the buying and selling process. The flexibility of loan programs and the potential for a higher loan amount, based on the after-repair value of the property, make hard money lending a valuable tool for Texas real estate investors navigating the dynamic and competitive Austin market.

What are Hard Money Rental Loans in Austin?

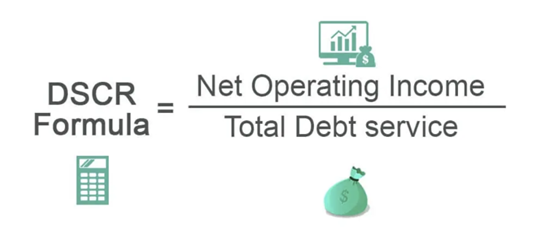

For our clients looking to hold their properties rather than flipping it. We offer a DSCR long term 30 or 40 year loan. Our Debt Service Coverage Ratio (DSCR) loan is a type of financing commonly used in real estate investments. It measures the ability of a property’s income to cover its debt obligations. Rather than your personal income, as most banks would look at your personal DTI, we look at the properties DSCR.

The DSCR ratio is calculated by dividing the property’s net operating income (NOI) by its total debt service, including principal and interest payments. A higher DSCR ratio indicates the deal has a better ability to cover debt payments and typically comes with better rates. Our DSCR loans are often sought by investors looking to purchase or refinance income-generating properties, such as commercial buildings or multi-unit residential complexes or 1-4 units.. At Tidal Loans, we offer competitive DSCR loans that cater to the unique needs of real estate investors, providing them with the financial support necessary to grow their portfolios and achieve their investment goals. Contact us today to explore our DSCR loan options and benefit from our expertise in the real estate lending industry.

What is a Hard Money Loan in Austin?

A hard money loan is a form of short-term lending that is backed by the property itself – the asset – not your creditworthiness. Instead of focusing on your credit score, WE DO NOT HAVE A MINIMUM CREDIT SCORE! Tidal Loans focuses on your property’s after repair value, which is used to estimate what the property is worth. The term “hard” money means your lender is underwriting the loan on this hard asset – your property. So, as a borrower you will not need to worry about putting a large amount of money down upfront as you would with a traditional loan.

This also means hard money loans tend to close much faster than traditional loans. When you complete a hard money loan with Tidal Loans, you won’t need to dig up your tax returns or deal with other banking issues as you would if your credit was on the line. If you have found a lucrative real estate option in Austin and want to close quickly, a hard money loan may be perfect because of its overall convenience.

If you are an investor with a large number of outstanding loans, Tidal Loans can help you continue to leverage your real estate investments with a hard money loan. And, because many conventional banks shy away from rehabilitation projects or properties that may be distressed, a hard money lender like Tidal Loans will provide 100% of the purchase and repair cost. This essentially leaves you with more money!

Other Austin Investment Property Loans

Fix and Flip Loans

We are one of the few lenders that can fund up to 100% of the Purchase Price and 100% of the Repairs because we are lending our own capital! We allow 100% CLTV( 100% fix and flip loans), so sellers can carry back a second note, allowing 100% of the purchase price and rehab

amount to be financed. These loans are designed specifically for investors who are interested in rehab and renovations to a fixer upper that you’d like to then sell for profit. Allowing our clients to bring nothing but closing costs to the table!

New Construction Loans

As Direct Hard money lenders Austin, we provide construction loans to builders and developers. These lenders offer financing up to 70% of the After-Construction Value and 100% of the hard construction cost. Unlike traditional loan institutions, hard money lenders in Austin like Tidal Loans could fund up to 85% Loan-to-Cost (LTC) even if you have bad credit. Real estate investors often use this type of loan for new construction projects because of the flexible terms, albeit at higher interest rates. In addition, these lenders could also assist with land acquisition, helping borrowers secure the investment property. This lending option, though more expensive than a conventional lender, can be quicker to close with fewer origination fees and closing costs.

Rental Property Loans / DSCR Loan

DSCR Loan Meaning: For our clients looking to hold their properties rather than flipping it. We offer a DSCR long term 30 or 40 year loan. What is a DSCR Loan? Our Debt Service Coverage Ratio (DSCR) loan is a type of financing commonly used in real estate investments. It measures the ability of a property’s income to cover its debt obligations. Rather than your personal income, as most banks would look at your personal DTI, we look at the properties DSCR.

DSCR Loan Requirements- We can provide a DSCR loan for Single Family Properties, 2-4 units, Multifamily properties, and Commercial Properties as well. We just need the following.

1.) Minimum credit score of 600

2.) Rent Ready Property

3.) Minimum Debt Service Coverage Ratio of at least .75 ( the higher the DSCR ratio the better the terms)

Calculating DSCR.

The DSCR ratio is calculated by dividing the property’s net operating income (NOI) for multi-family properties, or the rent income for 1-4 unit properties, by its total debt service, including principal, interest payments, taxes and insurance. A higher DSCR ratio indicates the deal has a better ability to cover debt payments and typically comes with better rates. Our DSCR loans are often sought by investors looking to purchase or refinance income-generating properties, such as commercial buildings or multi-unit residential complexes or 1-4 units. At Tidal Loans, we offer competitive DSCR loans that cater to the unique needs of real estate investors, providing them with the financial support necessary to grow their portfolios and achieve their investment goals..

Our landlord loans are great for buy and hold investors. Our program allows our clients to grow their portfolio faster. Investors can pull out up to 75% of the appraised value, even if you owned the property for just a week. We do not verify income either, because we care about the property cash flow, not our clients. Our rates start at very competitive and are 30 year fixed terms, 30 year amortization, allowing our rental property investors to cash flow more each month! We even have a 40 year amortization option as well!

Contact us today to explore our DSCR loan options and benefit from our expertise in the real estate lending industry

Airbnb Financing

Airbnb Loans / Short Term Rental Loans: We provide our buy at property. 30-year fix rate up to 80% LTV. We know the struggle with financing for Airbnb properties that is why we came up with this loan option for our Airbnb hosts! Buying a house for short term rental to place on Airbnb or VRBO is easy with Tidal Loans.

Transactional Funding

For wholesaler’s who need to double close with their seller. Tidal Loans will fund 100% of the closing with no cash out of pocket.

Multi Family Loans/ Mixed Used Loans

Our program consists of minimal down payment for multifamily apartment real estate investors looking for apartment rehab loans. We do not have a DSCR requirement for our multifamily rehab loans. Up to 85% LTC, 90% CLTV and 100% of rehab funds. This exclusive loan program for apartment buildings provides you with the flexibility and leverage to profit on Multifamily & Mixed-use investment opportunities that may need rehab or low occupancy. We also offer a 30-year loan program for investors looking to cashflow their property long term.

Commercial Property Loans->

We provide private commercial hard money loans for commercial real estate investors. We go up 65% LTV for our commercial bridge loans and commercial rehab loans. We offer 70% LTV and 80% CLTV on our long term commercial hard money loans at a 30 year amortization with a 30 year term. A commercial hard money loan is a good alternative to traditional bank financing when time is of the essence or borrowers don’t meet traditional guidelines for whatever reason.

Austin real estate investors feel free to reach out to us and see why we are considered to be one of the best hard money lenders in Wisconsin. We pride ourselves in offering a simple, fast, and transparent private money loan for your real estate investment needs. Avoid the red tape that goes along with bank financing and the time it takes to close traditional loan structures and look into a hard money loan with Tidal Loans

If you already have a property in Austin that needs some TLC, you may also want to talk to the experts at Tidal Loans about our “Fix and Flip” Loans , which are designed specifically for investors who are interested in rehab and renovations to a fixer upper that you’d like to then sell for profit.

Do you already have a property with equity? If so, contact Tidal Loans about a hard money refinance, which can help you pull cash out of your investment. In fact, Tidal Loans has numerous private money loan programs in which to choose: new construction loans for builders and developers, temp to perm loans for our buy and hold investors seeking passive income, and transactional funding for wholesaler’s who need to double close with their seller. Tidal Loans will fund 100% of the closing with no cash out of pocket. Tidal Loans will offer a simple, fast, and transparent hard money loan for your investment needs. Avoid the red tape that goes along with bank financing and the time it takes to close traditional loan structures and look into a hard money loan.

| Property Types | 1-4 Units | 5+ Units |

| Loan Types: | Fix and Flip Loans, Temp to Perm Loans, Hard Money Refinance Loans, New Construction Loans, Transactional Funding |

| Markets | Houston, Austin, San Antonio and Dallas/Fort Worth, Texas and submarkets |

| Loan Amounts | No Min- $3MM |

| Term | 3 months – 5years |

| Points | 2-4% |

| LTV | Up to 70% on “as is” or “as repaired” value if repairs are included |

| LTC | Up to 100% |