OUR RENTAL LOAN PROGRAM / DSCR FINANCE LOANS IS SPECIFICALLY TAILORED FOR INVESTORS NATIONWIDE SEEKING A SIMPLE AND FLEXIBLE FINANCING SOLUTION FOR ACQUIRING OR REFINANCING LONG TERM AND SHORT TERM RENTALS. OUR DSCR REAL ESTATE LOAN PROGRAM PRIORITIZES THE PROPERTY’S CASH FLOW INSTEAD OF THE BORROWERS PERSONAL INCOME.

Our Rental Loans / Debt Service Coverage Loan program provides long-term financing for single family residential properties, multi-family properties, commercial properties and portfolios. Rental property loans / DSCR finance loans are essential to building long term wealth through rental real estate. Tidal Loans mission is to provide our clients flexible, private real estate rental loans for long term and short term rentals, allowing our clients to attain financial freedom through real estate investing. We have experience achieving our mission not only in Houston, but throughout the state of Texas and across the country.

DSCR Loan Meaning: What does DSCR Mean? DSCR stands for debt service coverage ratio.. What is a DSCR Loan? Our Debt Service Coverage Ratio (DSCR) loan is a type of Non-QM financing commonly used in real estate investments. It measures the ability of a property’s income to cover its debt obligations. Debt obligations being the mortgage payments. Rather than your personal income, as the dscr meaning in banking would look at your personal DT (debt to income ratio)I, we look at the property’s DSCR. For our clients looking to hold their properties rather than flipping it. We offer a DSCR real estate long term loan in 30 or 40 year amortizations.

What is a good DSCR Ratio: A good debt service coverage ratio is anything above 1.25. Most lenders will require a minimum DSCR ratio of 1.25. At Tidal Loans we allow our real estate investors to qualify for a DSCR mortgage loan as low as .75. We also will approve a client lower than .75, however it will come with a lower LTV and higher rate.

Example of a DSCR Ratio Calculation: For example a 1.25 dscr means you the property generates 25% more income over the mortgage payment. Giving the real estate investor 25% of cushion to be able to sleep at night, The higher the number, the better the investor and us as the lender will be able to sleep at night:)

DSCR Requirements- We provide DSCR finance loans for Single Family Properties, 2-4 units, Multifamily properties, and DSCR Commercial Real Estate Properties. Our clients need to meet the following DSCR loan requirements.

1.) Minimum credit score of 500

2.) Rent Ready Property

3.) Minimum Debt Service Coverage Ratio of at least .75 ( the higher the DSCR ratio the better the terms) *Please note if your property does not meet our minimum debt service coverage ratio requirement, we can still fund your deal at a lower LTV and interest higher rate.

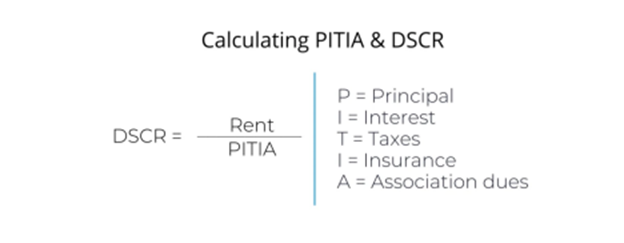

Calculating DSCR.

APPLY FOR A RENTAL LOAN NOW

See How We Made Funding a Reality for Others

The (DSCR) debt service coverage ratio is calculated by dividing the property’s net operating income (NOI) for multi-family properties, or the rental income for 1-4 unit properties, by its total debt service, including principal, interest payments, taxes, insurance and HOA dues. A higher DSCR ratio indicates the deal has a better ability to cover debt payments and typically comes with better rates. Our DSCR mortgage loans are often sought by investors looking to purchase or refinance income-generating properties, such as commercial buildings or multi-unit residential complexes or 1-4 units. At Tidal Loans, we offer competitive DSCR mortgage loans that cater to the unique needs of real estate investors, providing them with the financial support necessary to grow their portfolios and achieve their investment goals..

Our landlord loans are great for buy and hold investors. Our program allows our clients to grow their portfolio faster. Investors can pull out up to 75% of the appraised value. We do not verify personal income, because we care more about the property cash flow, not our clients personal cash flow. Our rates start at very competitive and are 30 year fixed terms, 30 year amortization, allowing our rental property investors to cash flow more each month! We even have a 40 year amortization option as well!

Benefits of DSCR Mortgage Loans:

- APPROVAL: Based on the property cash flow, instead of your personal income. Use rental income to qualify for mortgage.

- NO SEASONING HASSLES: Cash-out with no title seasoning requirements as long as the property was renovated.

- FOREIGN NATIONALS: Foreign nationals are welcome. We will require an LTV haircut and more reserves.

- INVESTMENT PROPERTY DOWN PAYMENT: As little as 20% down payment plus closing costs.

- INTEREST ONLY OPTION: Maximize cash flow today. Enjoy 10 years interest only, remaining 20 years amortized at the same rate. No rate surprises! Unlike an ARM, where your rate can potentially increase after the I/O period.

- LOW DSCR RATIO MINIMUM: DSCR down to .75.

- LOW MINIMUM FICO REQUIREMENT: FICO down to 620

- SHORT TERM RENTAL FINANCING: We use the short term rental market rates instead of traditional market rates when calculating DSCR for short term rental properties.

- VEST IN YOUR ENTITY NAME: Our DSCR mortgage loans do not show up on your credit report unlike some conventional rental property loans.

- VACANT PROPERTIES: For best terms we like to see an executed lease, but if you don’t have one, but your property is rent ready we can still fund your deal.

Contact us today to explore our DSCR loan options and benefit from our expertise in the real estate lending industry

Airbnb Financing

Airbnb Loans / Short Term Rental Loans: We provide our buy and hold investors short term rental loans property loans. 30-year fix rate up to 80% LTV. We know the struggle with financing Airbnb properties that is why we came up with this loan option for our Airbnb hosts! Find out why we are one of the top Airbnb Lenders in the country. Buying a house for short term rental to place on Airbnb or VRBO is now easy with Tidal Loans.

Texas and many other states around the country such as Florida, Georgia, North Carolina and Tennessee to name a few, have been a great place to invest and will be for the foreseeable future. Obtaining conventional financing can only take investors so far with their strict lending guidelines, seasoning requirements, and steep down payments. As a private money lender, Tidal Loans can open up your opportunity to invest in more Texas rental properties and other states as well.

We are private lenders that specialize in providing rental property loans for investors looking for landlord loans, portfolio loans, rental property loans and short term rental loans.

We are able to close our clients rental real estate loans quickly by our streamlined internal underwriting process, dedicated support staff, that emphasizes only the property level cash flow. Unlike conventional banks and hard money lenders, who underwrite borrowers personal finances. Our rental DSCR property loans are tailored for real estate investors to scale and grow their portfolios quickly.

Rental Loan Program Features:

30 Year Amortization and 30 Or 40 Year Term Options

- Our 30 or 40 year amortization allows our investors the ability to get the maximum amount of cash flow from their properties. It gives our clients peace of mind, so they do not have to worry about balloon payments coming due.

Flexible Amortization Options | Interest Only for 5, 7 or 10 years!

- Ex. Interest-only for five years, followed by 25-year amortization schedule. ● Fully amortizing over 30 years.

- No seasoning requirements if the property was renovated. No personal income verification. A true No- Income Mortgage Loan!

Verification! No Tax Returns Needed!

- Allows our clients to grow their portfolio faster. Investors can pull out up to 75% of the appraised value. We do not verify income either, because we care about the property cash flow, not our clients.

Approval is based on property cash flow, not personal finances

- We do not ask for any tax returns or look at personal debt-to-income ratios. Just the expected property cash flow. We analyze the expected property debt to income. Property debt-to-income calculation:

- Monthly amortized payment + Insurance + Property Tax + HOA dues/Monthly Gross Rent= DSCR calculation

Up to 75% LTV on cash-out refinance and 80% on purchases!

- Our investors love this, because they are able to pull out all their cash out they may have in the property, plus more for the next deal.

Low rates!

- We compete with competitive rates compared to conventional lenders!

Commercial Property Financing.

- Multi-Family loans & Mixed Use Loans- Up To 75% LTV.

- Retail, Office, Automotive, and Self-Storage loans- Up To 70% LTV.

No Experience Needed

- First time investors are welcome! Loans for rental properties are made easy with Tidal Loans.

Nationwide Lending

- We fund our private DSCR Mortgage Loans to investors nationwide!

Why partner with Tidal Loans on your next rental property loan?

- EFFICIENCY – We are direct private lenders and approve our loans in house. The property cash flow and value are what we underwrite. As a result, we can close loans as fast as 7 business days once we have a full file.

- EXPERIENCE– We have over 50 years of combined experience in real estate investing, and lending. We have and are in your shoes. Tidal Loans is here to help you on the front end, analyzing your potential deal to make sure your hard earned money will be safe and earning a solid return on capital.

What is the big deal about no seasoning?

Scaling your real estate investment in Texas at a significant pace is of substantial importance. Consider this, your total cost, including both purchase and renovation, is $100,000. Once the

refurbishment is done and a rental income source secured, the property’s appraised value escalates to $150,000. Most hard money lenders base their loan amount on the ‘loan to cost’ value if you decide to refinance within a year. Our unique approach with our rental property loans in Texas, however, offers investors more cash flow opportunity.

Unlike a conventional loan that may only give you $75,000 based on the initial cost, our Texas rental property loan program allows you to borrow up to 75% of the new appraised value. This means, you can potentially secure up to $112,500, significantly more than a typical loan amount from a mortgage lender. This enhances our investor’s capacity to grow their portfolio swiftly, seal more deals, and move a step closer to financial freedom via passive income. It’s a unique loan option in the realm of investment property loans, putting real estate investors on the fast track to increased wealth.

DSCR LOAN FAQ

What is a DSCR Loan?

DSCR stands for debt service coverage. Our Debt Service Coverage Ratio (DSCR) loan is a type of Non-QM financing commonly used in real estate investments. It measures the ability of a property’s income to cover its debt obligations. Debt obligations being the mortgage payments. Rather than your personal income, as the dscr meaning in banking would look at your personal DT (debt to income ratio)I, we look at the property’s DSCR. For our clients looking to hold their properties rather than flipping it. We offer a DSCR real estate long term loan in 30 or 40 year amortizations.

How to qualify for a DSCR Loan?

It’s pretty easy to qualify for a debt service ratio loan. We approve clients that meet the following requirements: . 1.) An investment property that cash flows at a DSCR ratio above .75. 2.) A rent ready property. Without much deferred maintenance. 3.) Credit score of at least 600.

How do DSCR Loans work?

DSCR (Debt Service Coverage Ratio) loans are specifically designed for investment properties, offering a unique financing approach. With DSCR loans, we evaluate the property’s income potential rather than solely relying on the borrower’s personal income. The rental income generated by the investment property plays a crucial role in determining loan eligibility and terms. We assess factors such as current and projected rental revenue, occupancy rates, and market rental rates (for short term rentals) We calculate the Debt Service Coverage Ratio by dividing the property’s rental income by the anticipated total debt service.DSCR loans enable investors to leverage the cash flow from their investment properties to secure financing for property purchases,

refinancing, or portfolio expansion, offering a tailored solution that aligns with their investment goals.

What are the DSCR Loan Interest Rates?

Your DSCR interest rate is dependent on the following: The loan amount, DSCR ratio, and credit score.

How can I improve my DSCR Loan Ratio?

Increase Rental Income: Explore ways to maximize the rental income generated by your investment property. Consider raising rental rates in line with market trends, enhancing property features or amenities, or implementing cost-effective property improvements that can attract higher-paying tenants.

Reduce Operating Expenses: Review your property’s operating expenses and identify areas where you can reduce costs without compromising the quality of the property. This could involve negotiating better vendor contracts, optimizing energy efficiency, or implementing cost-saving measures in property management.

Lower the Loan Amount: Lowering the loan amount will increase the debt service coverage ratio.